Financial Independence, Retire Early

I don't like the word "retirement". For most people, retirement means finally having the time to travel, pick up hobbies, volunteer, spend more time with loved ones, etc. While these things are all good, the word "retirement" carries the suggestion of leaving the workforce completely (usually at an older age, say 60 or 65) to, at last, enjoy whatever money you've saved over the years.

I prefer to use the phrase "Financial Independence", which in recent years has been growing in popularity (aka getting more likes) among the financial community. It's not defined by age or suggested post-work lifestyle and does not carry the same baggage as "Retirement". An increasing number of "FIRE (Financial Independence/Retire Early)" blogs have popped up, featuring real people achieving the unconventional goal of stopping full-time work in their 30s and 40s. This out-of-box thinking challenges our society's traditional system: Work until 65, then enjoy your life.

“WHAT IS FINANCIAL INDEPENDENCE?

“The state of having sufficient personal wealth to live, without having to work actively for basic necessities. For financially independent people, their assets generate income and/or cash flow from dipping into the assets that is at least as great as their expenses.””

Achieving FIRE means you don't need to wait. You're not working a regular job (that you hate) just to pay for basic expenses. Essentially, financial independence equates to having the freedom to choose how your time is spent (paid or not). For some people, that means a couple decades of extra time to do things like:

- Volunteer at a charity

- Travel

- Pick up hobbies

- Start a company

- Do some consulting

- Work part time at a fulfilling job

- Spend more time/focus on family

- Try something new

Sounds great, now how?

5 Keys to getting FIRE'd

1) Live a lifestyle that allows you to have Annual Savings

There's no secret here, there are only two variables. In order to have more annual savings, you have to either a) earn more or b) spend less.

Annual Income - Annual Expenses = Annual Savings

Adding income is not easy. While you could consider creative ways to add secondary income like creating a blog, consulting on the side, or finding a way to peddle stuff, it's still an uphill climb. Expenses however, may be easier to reduce by re-assessing your lifestyle (wants vs. needs) or by finding more efficient ways to save money (like building your own antenna or maximizing credit card points). Many people do not directly connect their lifestyle costs now to working longer later. An extravagant life now, means less savings, and more time working. It's that simple.

2) Invest Wisely, make your money work

Your GIC or High Interest Savings Account paying less than 1% is not going to cut it. Neither will high-cost mutual funds. Buying stocks on your own carries it's own set of risks (limited expertise, lack of diversification). I am a big proponent of a balanced and globally diversified portfolio of Index funds (ETFs) either purchased on your own and re-balanced regularly or using a robo-advisor to achieve the same. I expand on this passive investing strategy in my post on 3 Simple Tools for your Portfolio. My assumptions when I do Portfolio Reviews is that a growth portfolio is projected to rise about 6% per year over the long term (using FPSC guidelines).

3) Time

Remember step 1? Those savings need time to compound and grow. That's why it's even more important to start saving - and investing - early. It's much harder to find a large lump sum to fill in a shortfall later in life than it is to save a little now and plant the seed for long-term growth.

The age of reaching financial independence depends on how big of a Nest Egg is required to sustain expenses for the rest of your life.

4) Minimize Taxes

Our biggest expense is not housing, not food, not transportation....it is actually taxes! (See articles from Fraser institute). Using your government retirement accounts (RRSP, TFSA) wisely and deploying income splitting strategies can help minimize the amount of taxes paid throughout your lifetime. You'll need to assess your current income and compare it to your future income (pensions, CPP, RIF withdrawals) to help decide what your best strategy is. Don't automatically assume that the best strategy is to invest within your RRSP as this post I wrote discusses - STOP! Only fools rush in...to RRSPs.

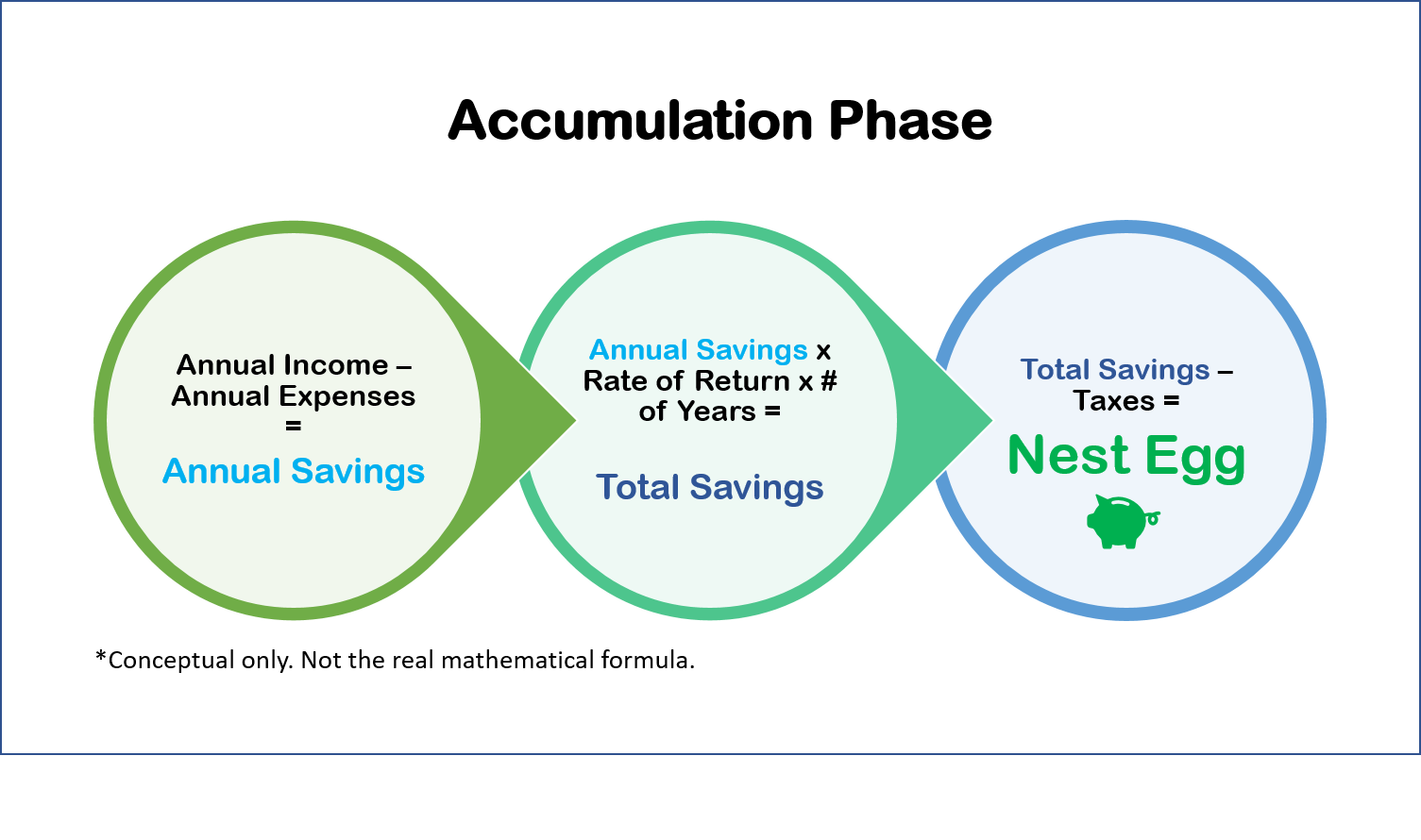

The accumulation formulas in the above image put together the key points #1-#4 as part of the Accumulation Phase to come up with your Nest Egg.

5) calculate your magic number

Assuming the 4% rule, your "Shortfall" per year must be equal to or less than 4% of your Nest Egg/Portfolio in order to be Financially Independent.

Having a good idea of what you plan to do after you've reached financial independence (volunteer, work on a hobby, start a business) will allow you to estimate how much your income and expenses will be. You can use the 4% rule as a ballpark to figure out the size of a portfolio/nest egg you need to sustain this lifestyle. For example, if your annual shortfall is $40,000 per year, you will need to have a portfolio of approximately $1,000,000 to help fund your expenses. You should hire a fee-for-service financial planner to do a more accurate projection as there are other elements to consider, like the above mentioned taxes and other sources of income like, CPP/OAS/pensions. I wrote a more detailed post about Reverse Engineering your magic number here.

The decumulation image shows why Step #5 is important. Your future income and expenses determine how much of a Nest Egg/Portfolio you need to reach Financial Independence.

Summary

FIRE (Financial Independence/Retire Early) may not be right for everyone. It all depends on your situation, interests, and goals in life. I have many clients that love their jobs and don't want to stop working any earlier than 65 (or at all!). However, even if you don't want to stop working early, you still need to save and strive for financial independence. If you retire and are NOT financially independent, you could actually run out of money, possibly becoming a burden to your adult children, loved ones, or worse - your not-so-loved ones.

The 5 keys to financial independence discussed above are variables that, to a certain extent, we can control. To gain a better understanding of your own personal situation and projected financial independence age, consider hiring a fee-for-service financial planner or money coach. They can better help you assess your unique situation and run future projections for you.

Contact me for a free 30 minute consultation to assess how soon you can reach Financial Independence!