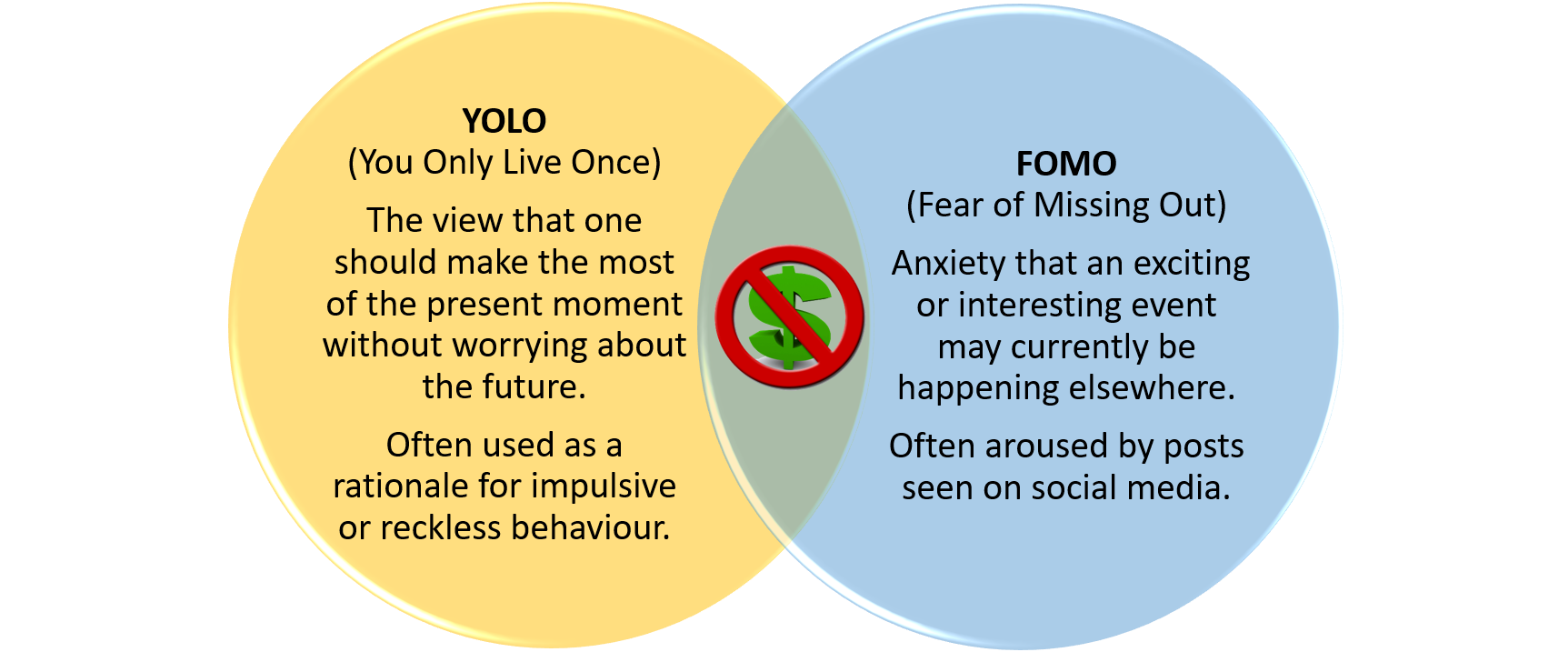

Okay, this post is not about generation wars. Whether we want to admit it or not, we all experience a little FOMO and exclaim YOLO once in a while. If you don't know what these acronyms mean, you might recognize some similar sentiments like "Keeping up with the Jones" or "Carpe diem!" . There's nothing wrong with any of these in moderation, but have you ever thought of how these behaviours can combine to damage to your finances?

Start with YOLO

YOLO Scenario 1: At a restaurant debating whether or not to get the extra (drink, appetizer, dessert, upsize, etc). YOLO! Let's do it. But is that really the last time you'll be at a restaurant? See you next week with the same choices all over again. Years later, all that YOLOing really adds up.

YOLO Scenario 2: Planning a family vacation debating a road trip vs. a Disney cruise. YOLO! Let's do Disney. You'll have a blast, that's pretty much guaranteed. But understand the trade-offs. Maybe that means less trips or traveling for the remainder of the year.

YOLO Scenario 3: Buying a house, stretching the limits of your mortgage capabilities. YOLO! Let's do it. You might think it's a once-in-a-lifetime opportunity, but the bank will be knocking on your door every month for the next 25 years. Putting most of your net worth in your primary residence is not only risky, it also affects your daily cash flow and lifestyle affordability. Garth Turner's rule of 90 suggests that no more than 90 minus your age = the % of which you should allocate to real estate. Where are you at?

Now add FOMO

FOMO Scenario 1: Everything looks delicious on Instagram. Those filters are amazing. But you know what else they are filtering out? The bill at the end of the meal, credit card debt, shattered dreams and expectations (too much?).

FOMO Scenario 2: Friends, family, coworkers - they will all have some exciting vacation or activity planned. And you'll see it all happen on social media, an end-of-trip slideshow, or a glowing tan when they saunter back into the office. It's difficult not to tell yourself, "I deserve it too" or wonder, "Why can't I....?" Whether it be joining in on a vacation since "everyone else is going", or signing kids up for extracurricular activities since "all the other kids are", these extra expenses are significant. Next time you find yourself grumbling about a certain activity, ask yourself if you're there because YOU want to be, or only because the 'Jones' are there.

FOMO Scenario 3: Real estate, especially in today's market, is a blood-sucking beast. Not only are you being pressured by your peers or parents to go "buy a place" (a largely Canadian phenomenon), the recent unnatural rise in real estate prices are tempting even the most conservative investors. However, taking on more debt than you should in order to enter this real estate market will put you and your family at risk. Not only can housing prices drop significantly (remember the 1990's?), real estate is a highly illiquid asset (even more so if you're living in it!). I'm not saying don't own your home - but I caution against owning too much house. Use your FOMO for good. Don't miss out on Stock Market growth- think of the lump sum of house money and interest payments that could be growing, instead of the extra dust in all those empty rooms.

#FINANCIALGOALS

I'm not a psychologist, but it's not difficult to see how our outlook on life can affect our behaviour, which inevitably affects our finances. When I consult with my clients, I try to draw out their personal goals, independent of social pressures or blind assumptions. We should break free from behaviours that are based on "because we've always done it that way", or "because everyone else is". Personal financial planning is about realizing unique priorities and targeting the areas that matter to you the most. You do only live this life once, but it's a long journey you want to survive, enjoy, be proud of, with or without the pictures to prove it.