Part of the challenge with managing cash flow is that the majority of us are a little low in the self-control and discipline department. We all know we should stick to a budget and spend less frivolously, but it's hard to do that without boundaries in place. If you feel that your spending and budgeting, or lack thereof, is getting out of control, you might want to try this 3-account cash flow system.

One way to help curb excessive spending is to create a system using "physical" buckets that make it harder to overspend. If the bucket runs out, you can't spend it. Likewise, if you've already set aside funds in a savings bucket, you'll be sure to have enough there when you need it.

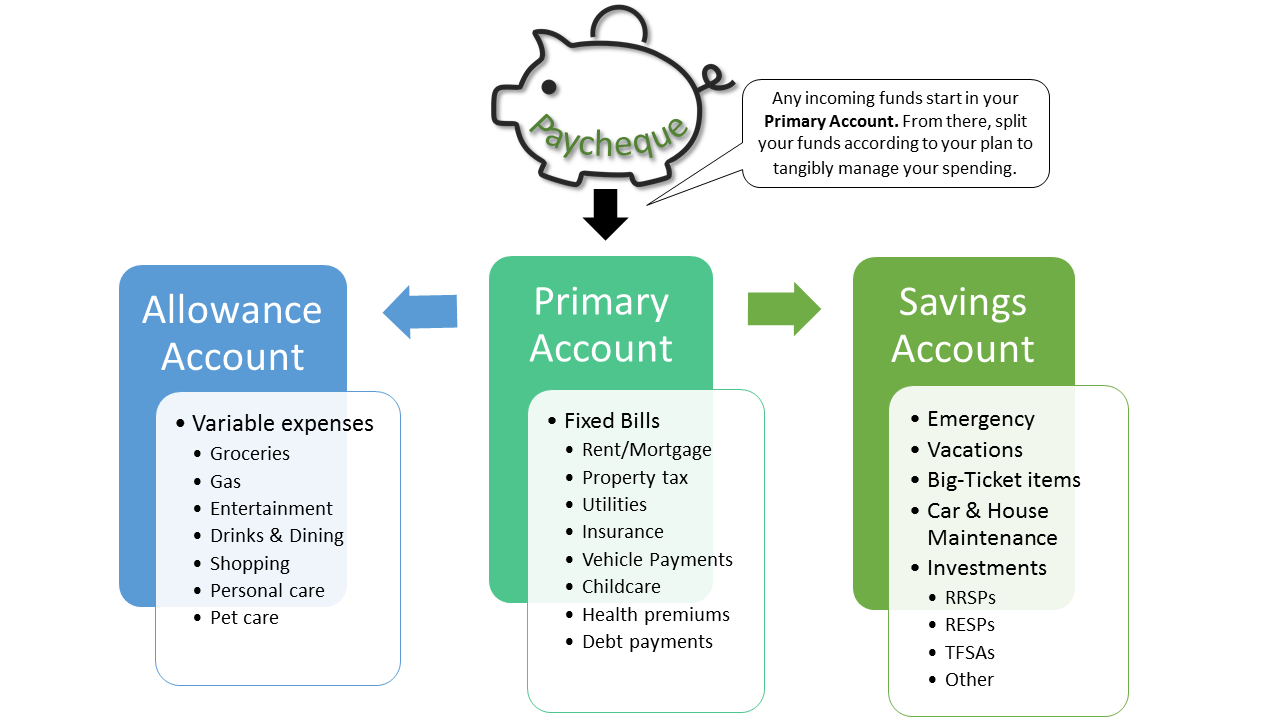

See below for a recommended cash flow system. Here I've defined some categories that you can use to segment your spending & savings. Once you've determined your budget, "physically" move your monthly income into the appropriate buckets; Each bucket is a separate dedicated bank account.

This 3-account system works together with your budget to control spending.

You may ask, "Why do I need to open three different accounts instead of using one Primary account for everything?". Answer: It takes the uncertainty out of managing your budget. You've already decided where your money is going, so you don't have to second-guess yourself each time you make a trip to the grocery store. If your Allowance account is empty, stop! Put those treats back on the shelf. Treat yo'self next month.

Of course, even with this system, some discipline and respect for the buckets is required. Sticking to the allocated funds rather than making exceptions and transferring accounts is key. Also, if you find yourself reaching for the credit card, or other type of advance-funding too often, consider moving to a real physical tactic like using cash-only where you withdraw cash each week and only use that.